Insurance Deductibles Explained: What You Should Know

Insurance Deductibles Explained: What You Should Know

Insurance deductibles are one of the most misunderstood yet financially impactful components of any insurance policy. Whether you are purchasing health insurance, auto insurance, home insurance, or even travel insurance, the deductible you choose can significantly influence your premiums, out-of-pocket costs, and long-term financial protection.

In this in-depth guide, we will break down what insurance deductibles are, how they work, why they matter, and how to choose the best deductible based on your financial goals. This article is especially valuable for readers in Tier-1 countries such as the United States, Canada, the United Kingdom, and Australia, where insurance costs and deductibles directly affect household budgets.

What Is an Insurance Deductible?

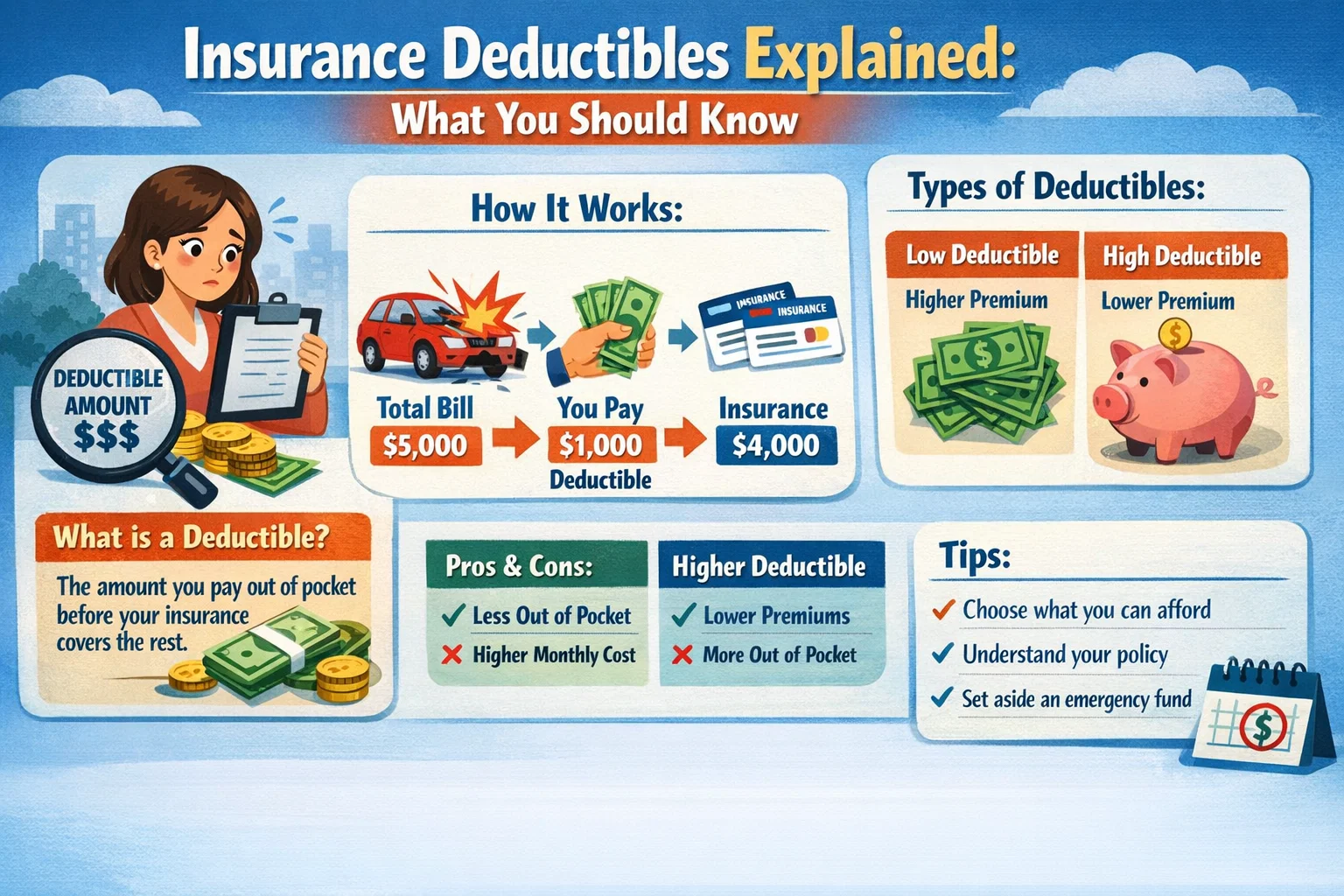

An insurance deductible is the amount of money you must pay out of pocket before your insurance provider starts covering eligible expenses. In simple terms, it is your share of the financial responsibility when a claim is made.

For example, if your car insurance policy has a deductible of $1,000 and you file a claim for damages totaling $5,000, you will pay the first $1,000, and your insurance company will cover the remaining $4,000.

Why Insurance Deductibles Exist

Deductibles exist to balance risk between the policyholder and the insurance provider. They discourage unnecessary claims, reduce administrative costs, and help insurers offer lower premiums to responsible policyholders.

From an insurer’s perspective, deductibles ensure that policyholders share part of the risk, which leads to more sustainable insurance pricing across all customers.

How Insurance Deductibles Affect Premiums

One of the most critical relationships in insurance is the inverse relationship between deductibles and premiums:

- Higher deductible → Lower monthly or annual premium

- Lower deductible → Higher monthly or annual premium

Choosing a higher deductible can significantly reduce your insurance premiums, making it an attractive option for financially stable individuals who can afford higher out-of-pocket costs if a claim arises.

Types of Insurance Deductibles

1. Health Insurance Deductibles

Health insurance deductibles are among the most important, especially in countries like the United States. A health insurance deductible is the amount you must pay for covered healthcare services before your insurer starts paying.

High-deductible health plans (HDHPs) often come with lower premiums and may qualify for Health Savings Accounts (HSAs), offering tax advantages.

2. Auto Insurance Deductibles

Auto insurance deductibles typically apply to collision and comprehensive coverage. You choose your deductible amount, commonly ranging from $250 to $2,000.

A higher auto insurance deductible lowers your premium but increases your financial responsibility in case of an accident.

3. Homeowners Insurance Deductibles

Home insurance deductibles may be set as a fixed dollar amount or a percentage of your home’s insured value. In disaster-prone regions, percentage-based deductibles are common for events like hurricanes or earthquakes.

4. Travel Insurance Deductibles

Travel insurance deductibles apply to medical emergencies, trip cancellations, and lost baggage claims. Lower deductibles provide peace of mind, especially for international travelers.

High Deductible vs Low Deductible: Which Is Better?

| Factor | High Deductible | Low Deductible |

|---|---|---|

| Monthly Premium | Lower | Higher |

| Out-of-Pocket Cost | Higher during claims | Lower during claims |

| Best For | Financially stable individuals | Frequent claim users |

| Risk Level | Higher personal risk | Lower personal risk |

How to Choose the Right Insurance Deductible

Selecting the right deductible is a strategic financial decision. Consider the following factors:

1. Emergency Savings

If you have sufficient savings to cover a higher deductible, choosing one can save you thousands in premiums over time.

2. Risk Tolerance

Individuals with a higher risk tolerance may prefer higher deductibles, while those who want predictable expenses may opt for lower deductibles.

3. Claim Frequency

If you frequently file claims, a lower deductible may be more cost-effective despite higher premiums.

Common Myths About Insurance Deductibles

Myth 1: Higher Deductibles Are Always Better

While high deductibles reduce premiums, they can cause financial stress if you are unprepared for sudden expenses.

Myth 2: Deductibles Apply to All Claims

Some services, especially preventive healthcare, may be covered without applying the deductible.

Insurance Deductibles and Tax Implications

In certain countries, insurance-related expenses may have tax implications. For example, high-deductible health plans paired with HSAs in the U.S. offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Real-World Example: Choosing the Right Deductible

Imagine two individuals purchasing car insurance:

- Person A chooses a $500 deductible and pays $1,800 annually.

- Person B chooses a $1,500 deductible and pays $1,200 annually.

Over five years without claims, Person B saves $3,000 in premiums. However, if an accident occurs, Person B must pay more upfront. This example highlights why deductible decisions must align with personal finances.

Tips to Lower Insurance Costs Without Increasing Risk

- Bundle multiple insurance policies

- Maintain a strong credit score

- Review deductibles annually

- Take advantage of insurer discounts

Final Thoughts: Mastering Insurance Deductibles

Understanding insurance deductibles empowers you to make smarter financial decisions, reduce unnecessary expenses, and maximize the value of your coverage. Whether you’re buying health insurance, car insurance, or home insurance, the right deductible can balance affordability and protection.

Always reassess your deductible as your income, savings, and lifestyle change. A well-chosen deductible is not just about saving money—it’s about long-term financial stability and peace of mind.

Comments (3)