Common Health Insurance Terms You Should Know

Common Health Insurance Terms You Should Know

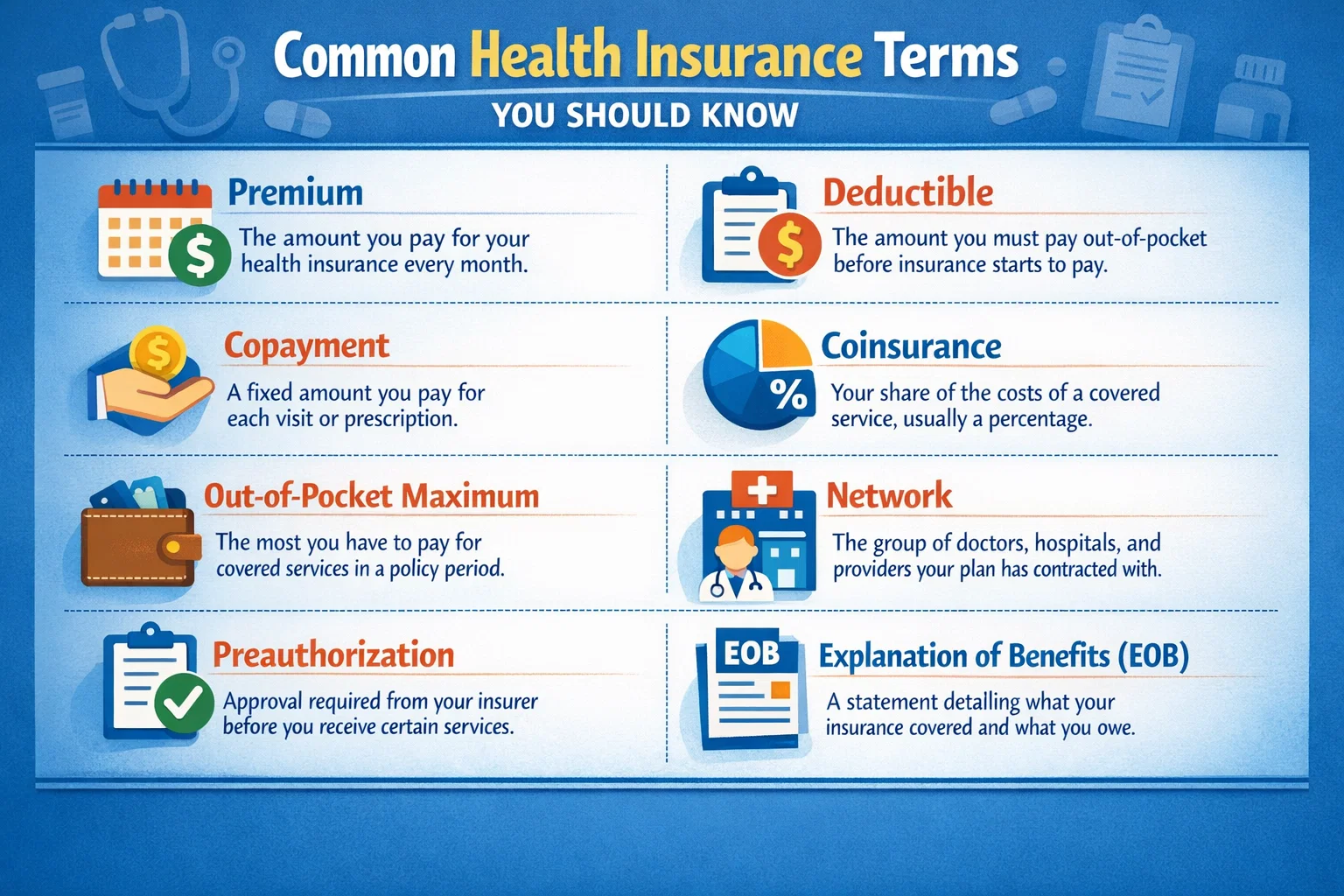

Health insurance can feel confusing, overwhelming, and filled with complex terminology—especially for first-time buyers. Yet understanding basic health insurance terms is one of the most important steps toward making smart financial and healthcare decisions.

In Tier-1 countries such as the United States, Canada, the UK, and Australia, misunderstanding insurance terminology can result in unexpected medical bills, claim denials, or choosing the wrong plan altogether. This detailed guide explains the most common health insurance terms you should know in 2026, using clear language and real-world examples.

Why Understanding Health Insurance Terms Is So Important

Health insurance policies are legal and financial contracts. Every word matters. Knowing the correct meaning of insurance terms helps you:

- Compare insurance plans accurately

- Avoid hidden medical costs

- Maximize benefits and coverage

- Prevent claim rejections

- Choose cost-effective health insurance

Advertisers and insurers expect consumers to understand these terms, which is why policies are written using standardized insurance language worldwide.

Premium

The premium is the amount you pay regularly (monthly, quarterly, or annually) to keep your health insurance active.

Key points:

- Premiums must be paid even if you don’t use medical services

- Lower premiums often mean higher deductibles

- Higher premiums usually provide better coverage

In Tier-1 countries, health insurance premiums can range from a few hundred to several thousand dollars per year, depending on coverage and location.

Deductible

A deductible is the amount you must pay out-of-pocket for medical services before your insurance starts covering costs.

| Deductible Type | Meaning | Best For |

|---|---|---|

| Low Deductible | Higher premiums, lower upfront costs | Families & chronic conditions |

| High Deductible | Lower premiums, higher upfront costs | Young & healthy individuals |

High Deductible Health Plans (HDHPs) are popular in the US due to tax benefits and lower monthly costs.

Co-Pay (Copayment)

A co-pay is a fixed amount you pay for specific healthcare services.

Examples:

- $30 for a primary care visit

- $50 for a specialist consultation

- $10–$20 for generic prescription drugs

Co-pays apply even after meeting your deductible in many plans.

Co-Insurance

Co-insurance is the percentage of medical costs you pay after meeting your deductible.

Example:

- Insurance covers 80%

- You pay 20%

Co-insurance continues until you reach your out-of-pocket maximum.

Out-of-Pocket Maximum

The out-of-pocket maximum is the maximum amount you pay in a year for covered services.

Once reached:

- Insurance covers 100% of eligible expenses

- Protects you from catastrophic medical bills

This is one of the most important terms for financial protection, especially in countries with expensive healthcare systems.

Network

An insurance network is a group of doctors, hospitals, and providers contracted with the insurer.

Types of networks:

- In-network: Lower costs

- Out-of-network: Higher costs or no coverage

Always check network hospitals before choosing a plan.

HMO, PPO, EPO, and POS

These acronyms define how your health insurance works.

- HMO: Low cost, limited flexibility

- PPO: Higher cost, more provider freedom

- EPO: No out-of-network coverage

- POS: Combination of HMO and PPO features

PPO plans are popular in Tier-1 countries for flexibility.

Pre-Existing Condition

A pre-existing condition is any medical issue you had before purchasing insurance.

Examples:

- Diabetes

- Heart disease

- Asthma

Disclosure is essential to avoid claim rejection.

Exclusions

Exclusions are services not covered by your insurance policy.

Common exclusions include:

- Cosmetic procedures

- Experimental treatments

- Non-prescribed alternative therapies

Always review exclusions before purchasing a policy.

Waiting Period

The waiting period is the time before certain benefits become active.

Examples:

- Maternity benefits: 9–12 months

- Pre-existing conditions: up to 24 months

Claim

A claim is a request made to the insurer for reimbursement or payment of medical expenses.

Claims can be:

- Cashless (direct hospital payment)

- Reimbursement-based

Digital claims processing has improved significantly in 2026.

Riders / Add-Ons

Riders are optional benefits added to your policy.

- Critical illness rider

- Accidental disability rider

- Global emergency coverage

Riders increase premiums but enhance coverage value.

Policy Term

The policy term is the duration your insurance coverage remains active, usually one year.

Renew policies on time to avoid coverage gaps.

Grace Period

The grace period is extra time allowed to pay your premium after the due date.

Missing payment beyond this period may result in policy cancellation.

Tax Benefits

Many health insurance plans offer tax deductions or credits, especially in Tier-1 countries.

Employer-sponsored plans often provide significant tax savings.

Common Mistakes Due to Misunderstanding Insurance Terms

- Choosing plans based only on low premiums

- Ignoring deductibles and out-of-pocket limits

- Not checking network hospitals

- Failing to disclose medical history

Expert Tips to Understand Health Insurance Better

- Read policy documents carefully

- Ask insurers for clarification

- Compare multiple plans

- Review policy annually

Final Thoughts

Understanding common health insurance terms empowers you to make confident, informed decisions. In 2026, healthcare costs are too high to rely on assumptions or guesswork.

Knowledge is your strongest insurance tool. The more you understand, the better protected you are—financially and medically.

Comments (3)