How to Choose the Right Health Insurance Plan in 2026

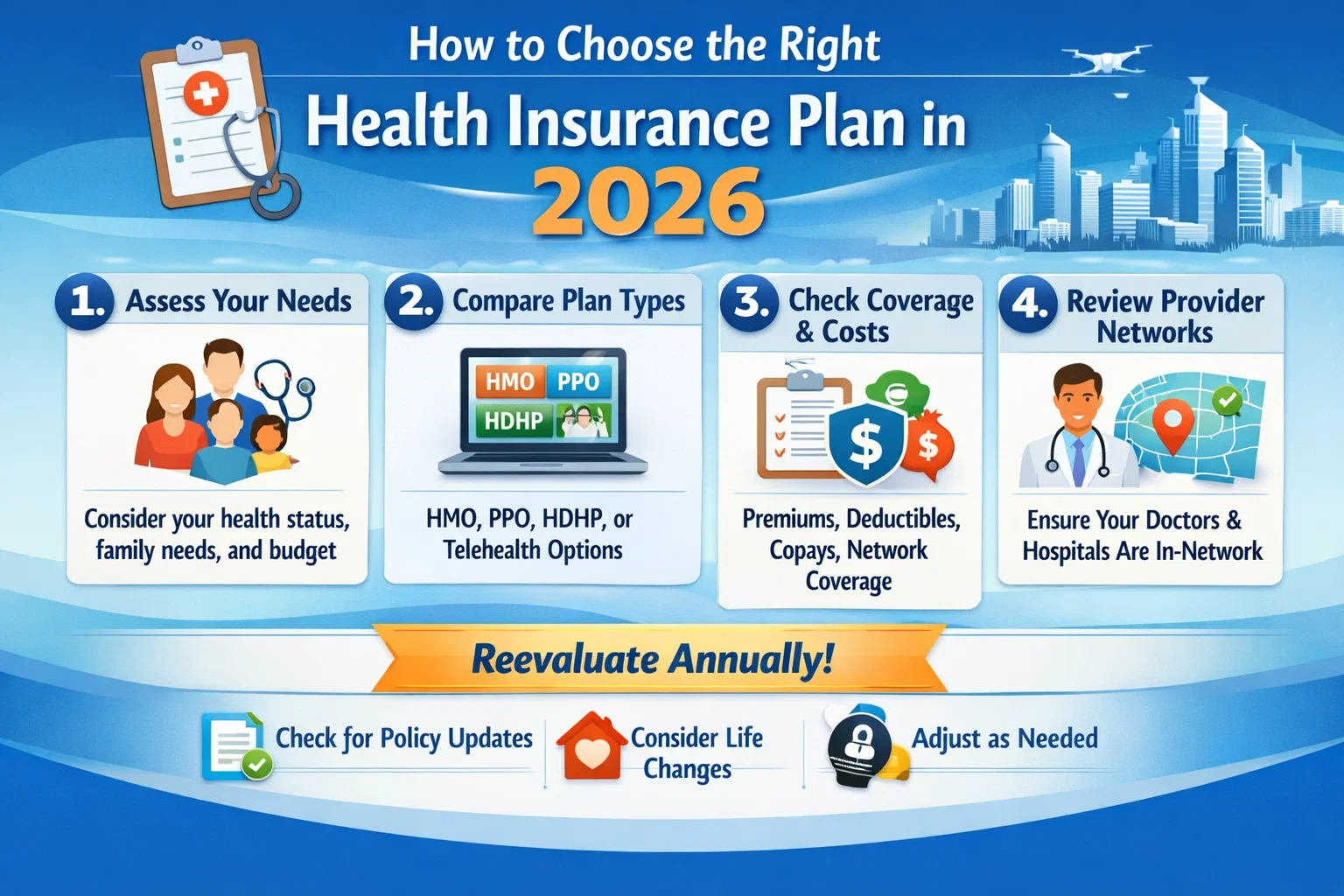

How to Choose the Right Health Insurance Plan in 2026

Healthcare costs are rising faster than inflation in most Tier-1 countries, making health insurance not just a safety net but a financial necessity. In 2026, choosing the right health insurance plan requires careful evaluation of coverage, premiums, deductibles, provider networks, and long-term value.

Whether you are purchasing health insurance for the first time, switching providers, or reviewing your existing plan, this comprehensive guide will help you make a smart, future-proof decision.

Why Choosing the Right Health Insurance Plan Matters More in 2026

In countries like the United States, a single emergency hospital visit can cost anywhere between $5,000 and $50,000+. Without adequate coverage, medical bills can quickly lead to long-term debt.

Key trends in 2026 include:

- Higher premiums due to medical inflation

- Increased use of AI-based diagnostics and treatments

- Greater focus on preventive care and mental health

- Stricter insurance underwriting policies

Choosing the wrong plan may result in high out-of-pocket costs, limited hospital access, or denied claims.

Step 1: Assess Your Personal and Family Healthcare Needs

Before comparing health insurance plans, start with an honest assessment of your medical needs.

Questions You Should Ask Yourself

- Do I need individual or family health insurance?

- Do I have any pre-existing medical conditions?

- How often do I visit doctors or specialists?

- Do I take prescription medications regularly?

- Am I planning major medical events (pregnancy, surgery)?

Your answers will determine whether you need comprehensive coverage or a basic, cost-effective plan.

Step 2: Understand the Types of Health Insurance Plans

Health insurance plans vary significantly in structure and cost. Understanding these types is critical when choosing the best plan.

Common Health Insurance Plan Types

- HMO (Health Maintenance Organization) – Lower premiums, limited provider network

- PPO (Preferred Provider Organization) – Higher flexibility, higher premiums

- EPO (Exclusive Provider Organization) – No out-of-network coverage except emergencies

- HDHP (High Deductible Health Plan) – Lower premiums, higher deductibles

In Tier-1 countries, PPO and HDHP plans are especially popular due to flexibility and tax advantages.

Step 3: Compare Coverage Benefits Carefully

Not all health insurance plans offer the same coverage. Always review the policy benefits in detail.

Essential Coverage to Look For

- Hospitalization and emergency care

- Outpatient consultations

- Prescription drug coverage

- Mental health and therapy sessions

- Maternity and newborn care

- Preventive health checkups

Plans with broader coverage may have higher premiums but offer better long-term value.

Step 4: Premium vs Deductible – Finding the Right Balance

One of the biggest mistakes people make is choosing a plan based only on low monthly premiums.

| Factor | Low Premium Plan | High Premium Plan |

|---|---|---|

| Monthly Cost | Lower | Higher |

| Deductible | High | Low |

| Out-of-Pocket Cost | Higher during claims | Lower during claims |

| Best For | Young & healthy individuals | Families & chronic conditions |

The right balance depends on how frequently you expect to use healthcare services.

Step 5: Check Provider Network & Hospital Access

Always verify whether your preferred hospitals, doctors, and specialists are included in the insurer’s network.

Out-of-network treatment can result in:

- Higher co-payments

- Lower reimbursement

- Claim rejections

In the US and Canada, network coverage is one of the most important factors affecting claim costs.

Step 6: Review Co-Pays, Co-Insurance & Out-of-Pocket Limits

Beyond premiums and deductibles, focus on these hidden costs:

- Co-pay: Fixed amount paid per visit

- Co-insurance: Percentage of treatment cost you pay

- Out-of-pocket maximum: Annual spending cap

Plans with lower out-of-pocket maximums provide better financial protection in worst-case scenarios.

Step 7: Evaluate Add-On Benefits & Riders

Modern health insurance plans in 2026 offer valuable add-ons:

- Critical illness coverage

- Accidental disability benefits

- Global emergency coverage

- Telemedicine & virtual doctor visits

These riders slightly increase premiums but significantly enhance coverage value.

Step 8: Compare Health Insurance Providers

Never choose a plan without researching the insurer.

Key Factors to Check

- Claim settlement ratio

- Customer reviews and ratings

- Financial stability

- Customer support availability

Top insurers in Tier-1 countries invest heavily in digital claim processing and faster reimbursements.

Step 9: Consider Tax Benefits & Employer Contributions

Health insurance premiums often come with tax advantages:

- Self-employed individuals may deduct premiums

- Employer-sponsored plans reduce taxable income

- Family plans may offer higher tax efficiency

Always factor in tax savings when comparing plans.

Common Mistakes to Avoid When Choosing Health Insurance

- Buying insufficient coverage to save premium

- Ignoring policy exclusions

- Not disclosing pre-existing conditions

- Skipping annual policy reviews

Expert Tips to Choose the Best Health Insurance Plan in 2026

- Think long-term, not just yearly costs

- Choose higher coverage in high-inflation countries

- Review policy annually

- Combine insurance with emergency savings

Final Verdict: How to Make the Right Choice

The best health insurance plan is one that balances affordability, coverage, and flexibility.

If you are young and healthy: Consider HDHP with preventive benefits.

If you have a family or medical needs: Opt for comprehensive coverage with lower deductibles.

In 2026, smart health insurance planning is not optional—it’s essential.

Make an informed decision today to protect your health and finances tomorrow.

Comments (3)