How Car Insurance Premiums Are Calculated

How Car Insurance Premiums Are Calculated

Car insurance premiums are not random numbers. In Tier-1 countries such as the United States, Canada, the United Kingdom, and Australia, insurers use advanced data models, actuarial science, and artificial intelligence to calculate premiums accurately.

Understanding how car insurance premiums are calculated empowers you to make smarter coverage choices, reduce costs legally, and avoid being overinsured or underinsured.

What Is a Car Insurance Premium?

A car insurance premium is the amount you pay to an insurance company to keep your auto insurance policy active. Premiums can be paid monthly, quarterly, semi-annually, or annually.

The premium reflects the insurer’s assessment of risk — how likely you are to file a claim and how expensive that claim could be.

The Core Principle Behind Premium Calculation

Insurance pricing is based on one core concept:

Higher risk = Higher premium

Insurers evaluate thousands of data points to predict:

- The probability of an accident

- The potential claim amount

- The frequency of claims

- Fraud risk

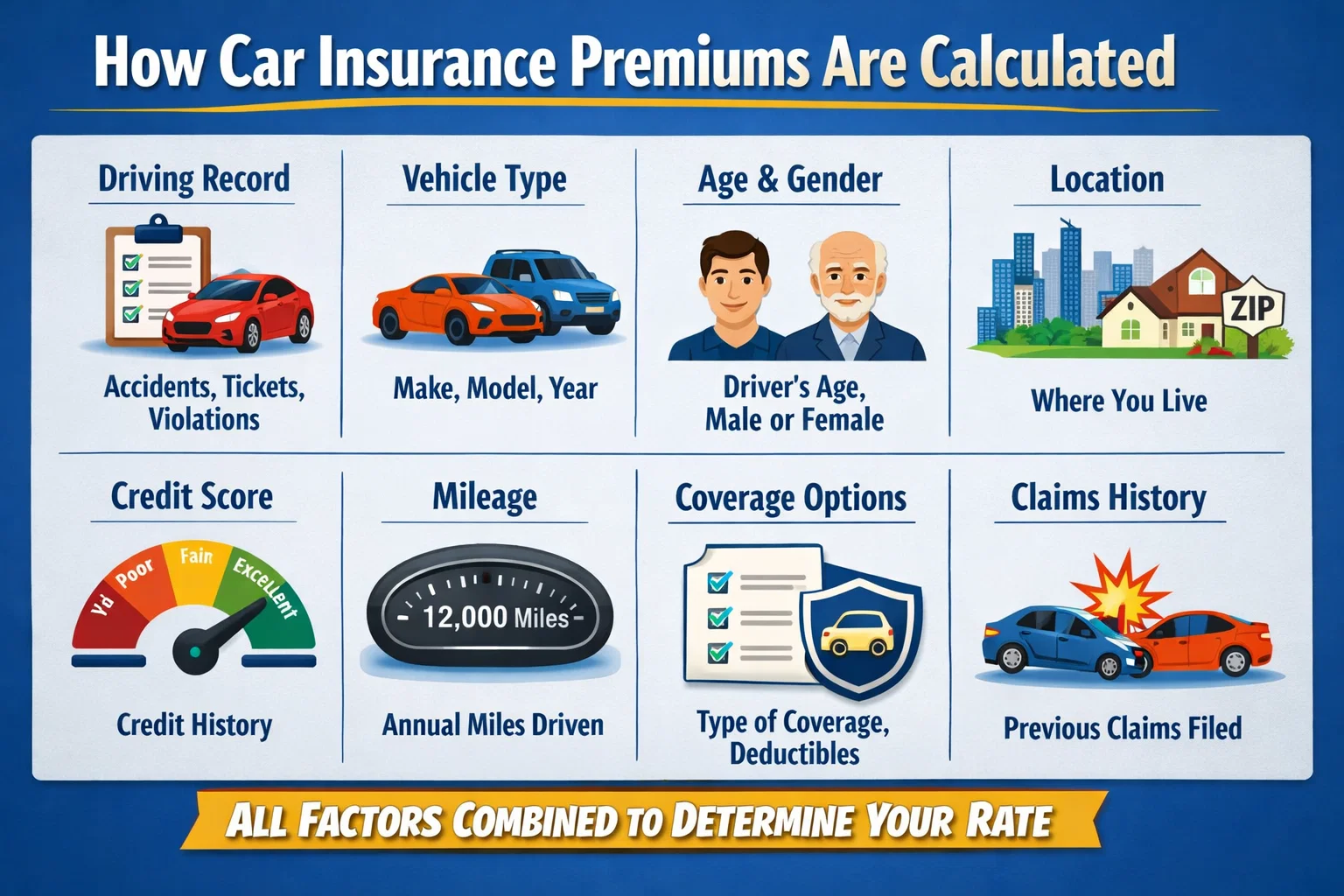

Primary Factors That Affect Car Insurance Premiums

1. Driver Age and Experience

Age is one of the strongest predictors of risk.

- Young drivers (under 25) pay higher premiums

- Middle-aged drivers receive the lowest rates

- Seniors may see increased premiums

Driving experience significantly lowers accident probability.

2. Driving History and Claims Record

Your driving record has a major impact on premium calculation.

Insurers analyze:

- Accidents (at-fault and not-at-fault)

- Traffic violations

- DUI or reckless driving

- Previous insurance claims

A clean driving history leads to substantial discounts.

3. Vehicle Type and Value

More expensive cars cost more to insure.

Insurers consider:

- Vehicle price

- Repair costs

- Spare part availability

- Theft rates

- Safety ratings

4. Location and Usage

Where and how you drive matters.

- Urban areas = higher premiums

- High traffic density increases accident risk

- Regions with theft or vandalism raise rates

Annual mileage also plays a role — more miles mean more exposure to risk.

Coverage Choices and Their Impact on Premium

Liability Limits

Higher liability limits increase premiums but protect you from lawsuits and large claims.

Collision and Comprehensive Coverage

Adding these coverages raises premiums but provides essential protection for your vehicle.

Deductible Amount

Deductibles directly affect premiums:

- Higher deductible = lower premium

- Lower deductible = higher premium

Choosing the right deductible balances affordability and risk.

How Insurers Use Data and AI in 2026

Modern insurance pricing uses advanced technology.

- Telematics and usage-based insurance (UBI)

- AI-powered risk scoring

- Real-time driving behavior tracking

- Predictive analytics

Safe drivers benefit from personalized, lower premiums.

Average Premium Breakdown Example

| Factor | Impact on Premium |

|---|---|

| Driver Age | High |

| Driving History | Very High |

| Vehicle Value | High |

| Location | Medium |

| Coverage Limits | High |

| Deductible | Medium |

Hidden Factors Most Drivers Don’t Know

- Credit-based insurance score (where legally allowed)

- Marital status

- Occupation

- Vehicle safety features

- Anti-theft devices

These variables help insurers fine-tune pricing accuracy.

How to Reduce Your Car Insurance Premium Legally

- Maintain a clean driving record

- Bundle auto and home insurance

- Increase deductibles responsibly

- Install safety and anti-theft devices

- Opt for usage-based insurance

- Compare policies annually

Why Comparing Quotes Is Essential

Each insurer weighs risk factors differently. The same driver can receive vastly different premiums from different providers.

Comparing quotes ensures:

- Competitive pricing

- Better coverage value

- Lower long-term costs

Future of Car Insurance Pricing

The future of premium calculation includes:

- AI-based real-time pricing

- EV-specific insurance models

- Pay-per-mile insurance

- Driver behavior-based discounts

Transparency and personalization are reshaping the insurance industry.

Final Thoughts

Car insurance premiums are calculated through a detailed risk assessment process designed to balance affordability and protection.

By understanding how insurers price policies, you gain control over your insurance costs and coverage quality.

Knowledge is the most powerful tool for lowering your car insurance premium.

Comments (3)