Term Life vs Whole Life Insurance: Key Differences Explained

Term Life vs Whole Life Insurance: Key Differences Explained

Choosing between term life insurance and whole life insurance is one of the most important financial decisions you will make. In 2026, with rising living expenses, long-term financial uncertainty, and increasing healthcare costs, selecting the right life insurance policy can significantly impact your family’s future.

This in-depth guide explains the key differences between term life and whole life insurance, helping you understand which option aligns best with your financial goals, lifestyle, and long-term plans.

What Is Life Insurance?

Life insurance is a contract where an insurer agrees to pay a lump-sum benefit to your beneficiaries if you pass away, in exchange for regular premium payments.

Life insurance serves multiple purposes:

- Income replacement

- Debt and mortgage protection

- Education funding

- Estate planning

- Wealth preservation

The two most popular types worldwide are term life insurance and whole life insurance.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the insured person passes away during the term, the beneficiaries receive the death benefit.

If the policy expires and the insured is still alive, no payout is made.

Key Features of Term Life Insurance

- Lower premiums

- Fixed coverage period

- No savings or investment component

- Simple and transparent

Term life insurance is widely used in Tier-1 countries for income replacement and loan protection.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifetime coverage.

In addition to the death benefit, whole life insurance includes a cash value component that grows over time on a tax-deferred basis.

Key Features of Whole Life Insurance

- Lifetime coverage

- Higher premiums

- Guaranteed death benefit

- Cash value accumulation

Whole life insurance is often used for estate planning and wealth transfer.

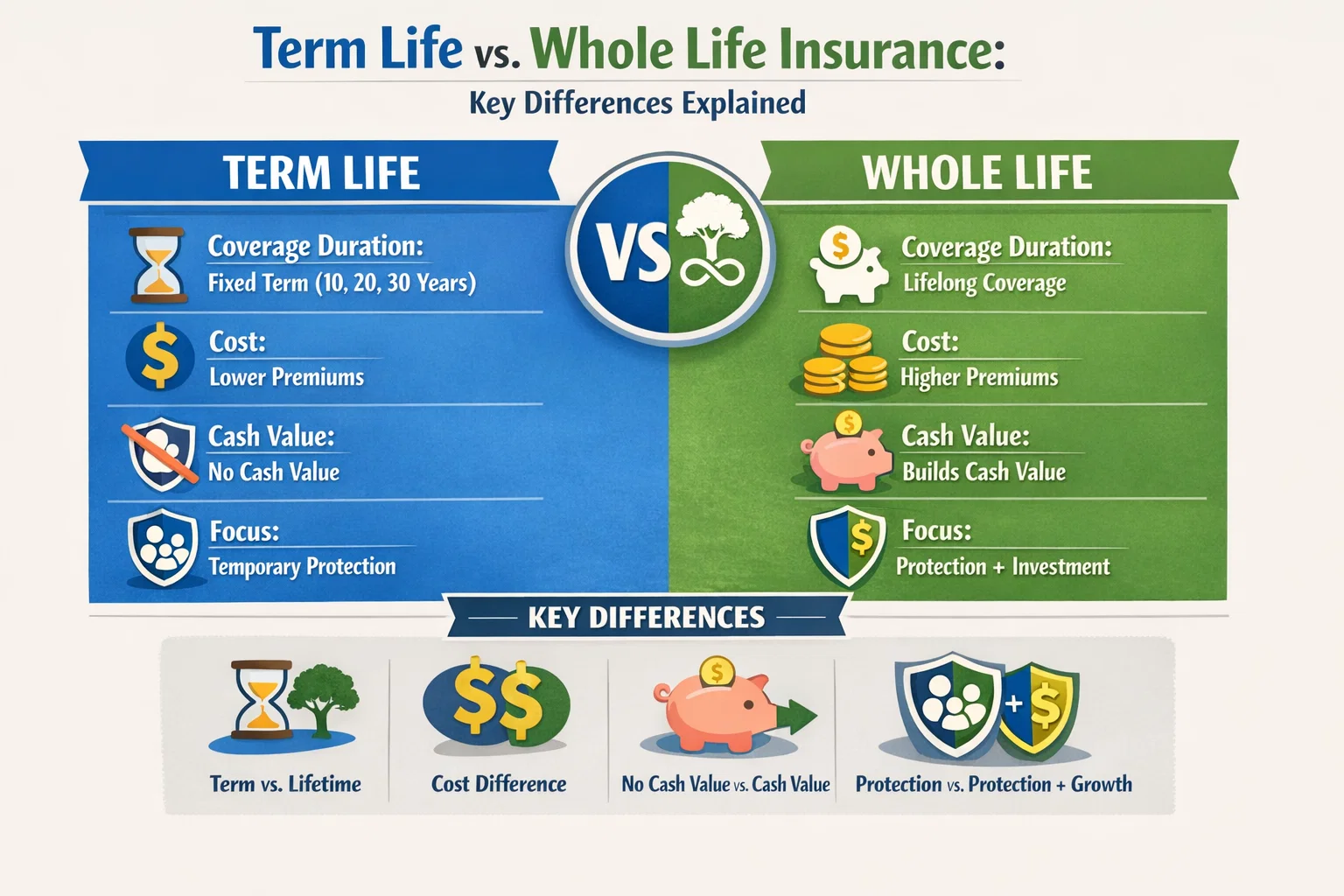

Term Life vs Whole Life Insurance: Side-by-Side Comparison

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10–30 years) | Lifetime |

| Premium Cost | Low | High |

| Cash Value | No | Yes |

| Death Benefit | Paid if death occurs during term | Guaranteed payout |

| Flexibility | Limited | Moderate |

| Best For | Income protection | Long-term wealth planning |

Cost Differences: Term vs Whole Life Insurance

Cost is one of the biggest differences between term and whole life insurance.

- Term life premiums are significantly lower

- Whole life premiums can be 5–10 times higher

- Whole life premiums remain fixed for life

For example, a healthy 30-year-old may pay a few hundred dollars per year for term life insurance, while whole life insurance could cost several thousand dollars annually.

Cash Value Explained (Whole Life Insurance)

The cash value component of whole life insurance grows over time and can be:

- Borrowed against

- Used to pay premiums

- Withdrawn (with tax considerations)

This feature makes whole life insurance attractive to high-income individuals and business owners.

Which One Is Better for Families?

For most families, term life insurance provides the best balance of affordability and coverage.

Term life insurance works well for:

- Young families

- Mortgage protection

- Children’s education funding

Whole life insurance may be suitable for families focused on long-term estate planning.

Which One Is Better for High-Income Earners?

High-income individuals in Tier-1 countries often use whole life insurance for:

- Tax-deferred wealth growth

- Estate tax planning

- Business succession planning

Term life insurance alone may not meet advanced financial planning needs.

Flexibility and Policy Customization

Whole life insurance offers more customization options through riders and policy loans.

Term life insurance is simpler but less flexible.

Tax Benefits Comparison

Both policies offer tax advantages:

- Death benefits are usually tax-free

- Whole life cash value grows tax-deferred

- Premiums may be tax-deductible in certain cases

Tax efficiency is a major reason advertisers and insurers promote whole life policies.

Common Myths About Term and Whole Life Insurance

- Whole life insurance is always a bad investment (false)

- Term life insurance is only for young people (false)

- Life insurance is unnecessary without dependents (false)

The best policy depends on your personal financial goals.

How to Choose Between Term and Whole Life Insurance

Ask yourself these questions:

- Do I need affordable coverage or lifelong protection?

- Do I want pure insurance or savings + insurance?

- Is my goal income replacement or estate planning?

Many financial experts recommend combining both policies for optimal coverage.

Can You Have Both Term and Whole Life Insurance?

Yes. Many people use a combination strategy:

- Term life for income replacement

- Whole life for wealth preservation

This hybrid approach provides flexibility and comprehensive protection.

Expert Tips for Buying Life Insurance in 2026

- Buy early to lock lower premiums

- Review coverage every few years

- Choose financially stable insurers

- Disclose all medical information

Final Verdict: Term Life vs Whole Life Insurance

Choose term life insurance if you want affordable, high coverage for a specific period.

Choose whole life insurance if you want lifetime protection, tax advantages, and wealth-building benefits.

In 2026, the right life insurance strategy is not about choosing one over the other—it’s about aligning coverage with your financial future.

The best life insurance policy is the one that protects your loved ones and supports your long-term goals.

Comments (3)